Boris Johnson attacked the SNP in an interview, saying his government would bring forward plans to “compensate for the grave inadequacies” of Scottish Government policy.

In an interview with BBC Scotland, the Prime Minister criticised taxation levels in Scotland, saying they were the highest in the UK.

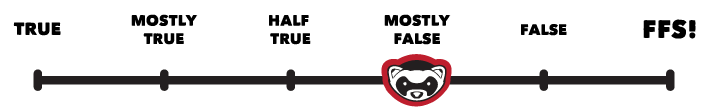

Ferret Fact Service looked at this claim and found it Mostly False

Evidence

Scotland gained full control over taxation in 2016 and first diverged from UK policy in the 2017-18 tax year. However, the following year witnessed the first major deviation from UK policy when a five-band system was put in place.

The Scottish Rate of Income Tax (SRIT) replaced the three-band system and reduces the tax on low earners, but increases it for higher earners.

SRIT includes a starter rate of 19 per cent, a basic rate of 20 per cent, and an intermediate rate of 21 per cent. Higher earners pay a 41 per cent tax, while those at the top tax bracket paying 46 per cent.

This contrasts with the three bands of 20 per cent, 40 per cent and 45 per cent in England and Wales.

Boris Johnson’s claim is that Scotland has the highest taxes anywhere in the UK. But this depends on how taxation is measured.

Certainly, Scotland’s top tax rate is the highest of any UK nation, set at 46 per cent top which is higher than the 45 per cent rate used across the rest of the UK.

| 2018-19 | 2019-20 | ||

|---|---|---|---|

| Band | Rate | Band | Rate |

| Over £11,850 - £13,850 | 19% | Over £12,500 - £14,549 | 19% |

| Over £13,850 - £24,000 | 20% | Over £14,549 - £24,944 | 20% |

| Over £24,000 - £43,430 | 21% | Over £24,944 - £43,430 | 21% |

| Over £43,430 - £150,000 | 41% | Over £43,430 - £150,000 | 41% |

| Above £150,000 | 46% | Above £150,000 | 46% |

The Scottish Parliament Information Centre (SPICe) has calculated the amount Scots are taxed in the 2019-20 tax year.

Most Scots are paying less in the current tax year than in the previous year. The Scottish Government estimates this equates to 99 per cent of taxpayers.

This change is primarily down to an increase in the personal allowance, the tax-free amount set by the UK government (currently at £12,500). The Scottish Government has also made alterations to thresholds at which tax rates kick in, with a five per cent increase in the threshold for the basic rate and a four per cent increase in the threshold for the intermediate rate.

However, when compared to the rest of the UK, many Scots pay more tax. All those earning more than £27,000 pay more in Scotland.

The Scottish Government estimates that 45 per cent of taxpayers will pay more than their counterparts in the rest of the UK. This means that the majority of those living in Scotland will be taxed the same or less but those earning in the higher tax brackets will be more affected.

Income tax is only one of the elements of taxation which affects the amount of money people have to spend. Council tax is calculated differently in Scotland and England, and the majority of Scottish households pay less in council tax than those in England. This is a consequence of the nine-year council tax freeze put in place by the Scottish Government. Council tax averages are usually measured by using the Band D.

As the Fraser of Allander Institute explains: “As a result of the nine year council tax freeze in Scotland, council tax north of the border for the average band D house is now some 14 per cent lower in real terms in 2019-20 than it would have been had it kept pace with inflation.”

“By 2019/20, average band D council tax in Scotland is 21% lower than in Wales and 28% lower than in England.”

It should be noted that levels of taxation do not give a complete picture of how much money people have to spend. Scotland and the rest of the UK also have different benefits which impact on people’s overall income, as well as differing costs for things such as childcare, care for the elderly and education.

Ferret Fact Service verdict: Mostly False

Boris Johnson’s claim that Scotland has the highest taxes anywhere in the UK is misleading. He is accurate that Scotland’s top band tax rates are higher than other UK nations but these affect those earning over £27,000, which the Scottish Government estimates to be around 45 per cent of the country. Scotland also has lower council tax bills due to a nine-year freeze on rates.

Ferret Fact Service (FFS) is a non-partisan fact checker, working to the International Fact-Checking Network fact-checkers’ code of principles. All the sources used in our checks are publicly available and the FFS fact-checking methodology can be viewed here. Want to suggest a fact check? Email us at factcheck@theferret.scot or join our Facebook group.

Photo thanks to Annika Haas, CC BY 2.0.