One of the most controversial aspects of the Scottish budget was only added at the eleventh-hour.

The so-called ‘car park tax’ was voted through by MPs in January, after negotiations between the SNP and the Scottish Greens.

Scottish Conservative MSP Miles Briggs suggested that Scots were looking at a £500 yearly fee for parking at work.

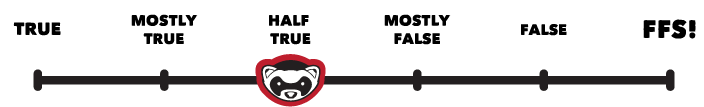

Ferret Fact Service looked at this claim and found it to be Half True.

Evidence

The Scottish budget looked set to be rejected by MSPs until late negotiations with the Scottish Greens allowed its passage through Holyrood.

The price for the Greens’ support was extra support for councils, a consultation on a replacement for council tax, and specific extra powers handed to local councils.

One of these was handing local authorities the power to set a workplace levy (WPL) on car parking spaces.

This means that the Scottish Government will support an amendment to the Transport (Scotland) bill “that would enable those local authorities who wish to use such a power” to put in place a tax on parking at a place of work. The amendment will exclude hospitals and NHS properties.

It gives councils the ability to charge companies an annual tax on car parking spaces they provide for employees. The company would then have the option to pass this cost on to their employees.

The move is intended to incentivise alternatives to the car and provide extra funding for public transport and infrastructure.

The move was supported by environmental organisations and some reform groups, but criticised by the Conservatives, Scottish Labour and the Liberal Democrats, as well as unions and business organisations.

The Conservatives suggested that Scots would need to pay £500 per year to park at work. This figure is misleading, and comes from the levy introduced by Nottingham City Council after the power was handed to local council by the UK government.

Nottingham’s WPL is the only such tax in the UK and has been in place since 2012. The latest cost for employers with over 11 spaces is £415 per space.

Under the Nottingham council WPL employers can pass on all or part of the cost from employees.

So far, the details of any WPL in Scotland are sketchy, and there has not been any confirmation of rates or eligibility criteria.

Edinburgh City Council and Glasgow City Council have indicated they could introduce a levy should the law be introduced.

The Conservatives were also questioned over their suggestion that the levy represented an ‘SNP car park tax’, as the power to collect and spent the money raised would be for local councils rather than central government. It also originated with the Scottish Greens.

While this is correct, it is accurate to say that the SNP-led Scottish Government are supporting and introducing this taxation power, and are ultimately responsible for its potential introduction.

Ferret Fact Service verdict: Half True

The Scottish Conservatives are correct that the new workplace levy would likely mean workers being charged to park at work, although this would only include those who were parking in designated space provided by their employer. It would not include free street parking and those who pay for existing parking not provided through their workplace. The figure of £500 per year is an estimate taken from the approximate cost of the levy in place in Nottingham, while no rate has been agreed at this stage.

Ferret has made another error in conclusion about evidence it cites in this instance

1. SNP when it was originated by the Greens and

2. could only be set by local authorities of whatever party,

3. then to endorse the naming by Tories “SNP car park tax” when it is not a tax on car parks, but on employer provided free spaces to employees and

4. take the £500 “price tag” as accurate in some way when the only existing scheme charges £415 and there is no recommendation

5. “the scheme will hit hard working Scots” is unproven since this tax will be payable by employers.

So on each of these substantive counts the Briggs post is inaccurate and a “mostly false” conclusion would be more realistic.

I agree with noidletalk, this is an unfair conclusion.

Agreed. No mention of benefits coming from levy income to public transport and walking and cycling. Also Notts scheme only applies to employers with more than 10 spaces. My faith in Ferret has taken a knock.

Methinks the Ferret journo who wrote this has parking at his/her workplace. A lightweight, misleading article that lets down the journal.

Yes – a disappointing Ferret analysis. Echoing the Tory “tax” scaremongering – citing the highest annual figure in the UK (inc VAT). Somehow £1 or £2 per day doesn’t quite have the same Tory tarnish – particularly when compared to existing parking meter charges in Glasgow & Edinburgh!.

And ignoring that any decision would be made locally. There’s really only the 2 major cities in Scotland with the density of use (and public transport alternatives) that might warrant considering such a charge. As any scheme would need to link to improving Public Transport, cycling and walking – and where such a tax would be part of a wider strategy to reduce car journeys (and the related pollution). And also give positive uses to redundant city centre car parks?

I was on the edge of assessing such schemes in an english City some 16 to 20 years ago. In the end the effort was put in to promoting “car sharing schemes” – including banning vehicles with a single driver from key busy lanes at peak hours (could this be applied to M8/M74 in Glasgow?). But alongside planning policies that gave greater emphasis to more “cycle parking” and replacing free “provision of city centre business parking places” with a funding levy towards public transport (and so encouraging better use of the land)