The governments of China, Qatar, Singapore and the United Arab Emirates have extensive property portfolios in Scotland collectively worth nearly £250m.

Among the properties owned by these states – often purchased using money from their national investment funds – are warehouses, office buildings, student accommodation, Highland estates, and a private island.

These owners were revealed through The Ferret’s analysis of the new Register of Overseas Entities, which has revealed for the first time the true owners of some of Scotland’s properties.

Our findings have prompted concerns about the growing influence of foreign states — which have chequered human rights records – over Scotland’s economy.

The Scottish Greens described the sums of money involved as “staggering” and argued Scotland’s land and resources should not be benefiting regimes with poor human rights records. Transparency International queried whether the country’s “national infrastructure is in safe hands” and said there should be an “informed debate” about overseas ownership of property.

China

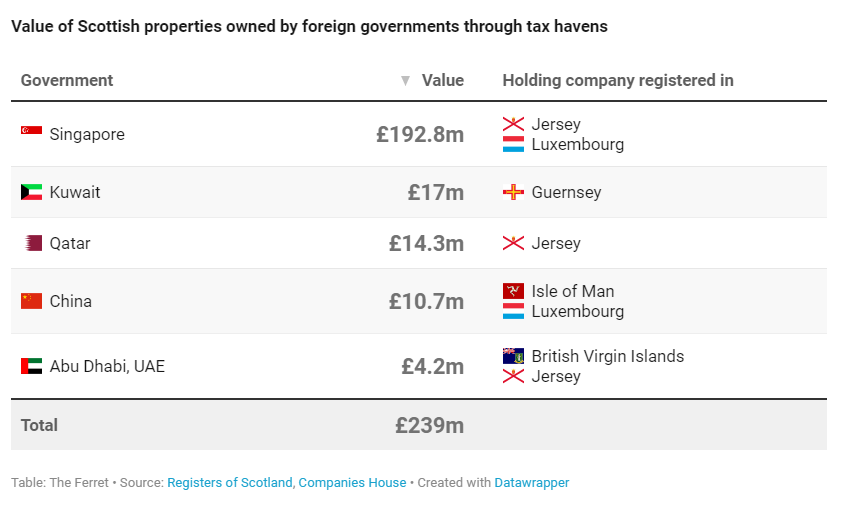

The China Investment Corporation (CIC) — a corporate entity owned by the Chinese government — owns properties worth collectively £10.7m, through firms registered in Luxembourg and the Isle of Man.

Headquartered in Beijing, the CIC was founded in 2007 as China’s sovereign wealth fund and is mandated to make overseas investments and “seek maximum returns for its shareholders within acceptable risk tolerance”.

CIC’s property in Scotland includes premises at Houston Industrial Estate in Livingston, the Clydesmill Industrial Estate, Carmyle, and block six at Inchinnan Business Park in Inchinnan, Renfrewshire. CIC also owns 17 Arkwright Way in Irvine – a commercial block in North Newmoor Industrial Estate.

Elsewhere, CIC has a long term lease on 7 South Gyle Crescent in Edinburgh, and it is owner of a Bathgate path.

China has been condemned by Amnesty International for human rights abuses which include the “systematic repression” of ethnic minorities in Xinjiang and Tibet.

This is particularly worrying for Scotland as there will always be political influence where there are such large sums of money involved.

Emily Apple, Campaign Against Arms Trade

Qatar

The state of Qatar’s holdings in Scotland are worth £14.3m. This includes Cluny Estate, near Laggan, and its fishing rights, at a total value of £7.3m. Qatar also owns Eilean Aigas Estate, which is on a private island near Beauly, valued at £7m. The properties are owned through firms registered in Jersey, including Goldenrod Limited.

Qatar also has a poor human rights record. It has been embroiled in controversy over its discrimination against women and LGBTQ people, and lax labour laws which allowed the exploitation of migrant workers in the construction of infrastructure for the 2022 football World Cup.

Qatar’s role in the war in Yemen — backed by UK arms sales — has also been criticised by human rights groups such as Campaign Against Arms Trade.

The Abu Dhabi Investment Authority — in the United Arab Emirates — owns Newbridge Industrial Estate, near Ratho, Edinburgh, through a Jersey-registered company called Akaria Investments Limited. The total value of its property is £4.2m.

The UAE has been accused of suppressing freedom of speech, unfair trials, and misusing Israeli spyware to gain access to the communications of journalists, activists, and world leaders.

Kuwait

The Kuwait Investment Company is listed as a beneficial owner of Blackburn Business Park, outside Aberdeen, via a Guernsey-registered company called Archer Investments Limited. The property is valued at nearly £17m.

According to Amnesty International, Kuwait discriminates against the Bidun, who are native stateless Kuwaitis, in access to education and healthcare, and the government opposes peaceful demonstrations.

Singapore

We also found that the Ministry for Finance Singapore has property worth £46.6m. Its assets include student accommodation at Beaverbank Place in Edinburgh.

Last year, a partnership between the Singapore sovereign wealth fund, GIC, and an American investor also purchased a portfolio of Scottish student accommodations worth nearly £150m.

Amnesty International reported last year that Singapore used “repressive laws” to silence dissent and hangings resumed after a half-year pause.

‘A question of power’

Scottish Greens MSP Ross Greer said The Ferret’s revelations are “very concerning and the sums of money involved are staggering”. He argued it should not be possible for these regimes to “buy up property like this”, adding: “Fundamentally this is a question of power, and this research underlines the need for far greater transparency and regulation over land ownership in Scotland.”

Emily Apple, of Campaign Against Arms Trade, claimed the vast sums of money being invested in property in Scotland is “indicative of the attitude” the UK Government has towards nations that abuse human rights.

“Time and again the drive for profit outweighs any human rights considerations,” Apple claimed, pointing out the UK Government has licensed £3.2bn worth of military exports to Qatar since 1 October 2019.

She added: “It is sadly unsurprising that human rights abusing regimes are also allowed to invest in property. This is particularly worrying for Scotland as there will always be political influence where there are such large sums of money involved.

“Urgent action is needed by both the English and the Scottish governments in ensuring that the lives of people living under these regimes are prioritised over profit."

Juliet Swann, senior policy officer at Transparency International UK, said “relentless campaigning over seven years has finally lifted the veil of secrecy” over foreign ownership of real estate across the UK, “often hidden until now in shell companies registered in offshore tax havens”.

But more needs to be done, Swann stressed, arguing there are still “too many loopholes that can be exploited” to hide the real owners of land in Scotland. Tomorrow, The Ferret will reveal the impact of “loopholes” in the new legislation, as part of this series.

“With the information out in the open, we can have an informed discussion about it,” added Swann “Are some parts of our national infrastructure in safe hands? What's more, people in other countries might now ask their governments why they choose to invest funds here”.

In 2020, The Ferret revealed that foreign companies owned £4.4bn worth of Scottish property, prompting calls for greater transparency to stop Scotland losing out on tax revenue.

Registers of Scotland data obtained by The Ferret then showed that on the last day of 2019, there were 3,237 Scottish properties owned or leased by companies based outside of the UK.

Jersey, the Isle of Man, the British Virgin Islands, Guernsey and Luxembourg are the places whose companies own the most Scottish property.

The governments of all states named in this article were asked to comment.

Scotland’s secret owners is a Ferret investigation exclusively produced in partnership with The Herald. The Ferret is a media-coop, which works with its members to produce investigations in the public interest. Sign up to our newsletter to find out more or become a member at theferret.scot/subscribe

Wait, why wouldn’t an X country’s investment fund register the holding company in country X? That’s odd