Global firms linked to tax havens own or operate Scottish theatres, music venues, pubs and bars, analysis by The Ferret has found.

Cultural icons including the Edinburgh Playhouse, Glasgow’s King Tut’s Wah Wah Hut, TRNSMT music festival, and pub chains with hundreds of sites across Scotland’s cities are ultimately owned or operated by companies with links offshore.

The findings are part of a special series by The Ferret called Who Owns Urban Scotland which investigates the firms behind major parts of Scotland’s towns and cities.

Campaigners said the findings showed that much of the prosperity produced by Scotland’s “rich and diverse” cultural sector risks being “hoovered up” by multinational investors based in tax havens.

The “homogenising effects” of ownership by “remote and disinterested” investors could also threaten the “variety, experimentation and autonomy” which helps Scottish cultural life to thrive, one expert warned.

Meanwhile, pubs and bars across the country are owned by companies based in the Cayman Islands and Luxembourg. These include all of Scotland’s Belhaven bars alongside numerous other community pubs.

Many of these local cultural hubs, which are “vital to their customers and communities”, could be converted to housing or shops as tax havens and other overseas investors look to maximise their returns, according to the Campaign for Real Ale.

Tax havens are territories which allow businesses and other wealthy individuals to avoid tax and let companies keep much of their financial information secret. The UK treasury is estimated to lose billions of pounds in revenue to them each year.

There is no evidence or suggestion that any of the companies are breaking the law and they claim that they pay all relevant tax in the UK.

Tax haven links

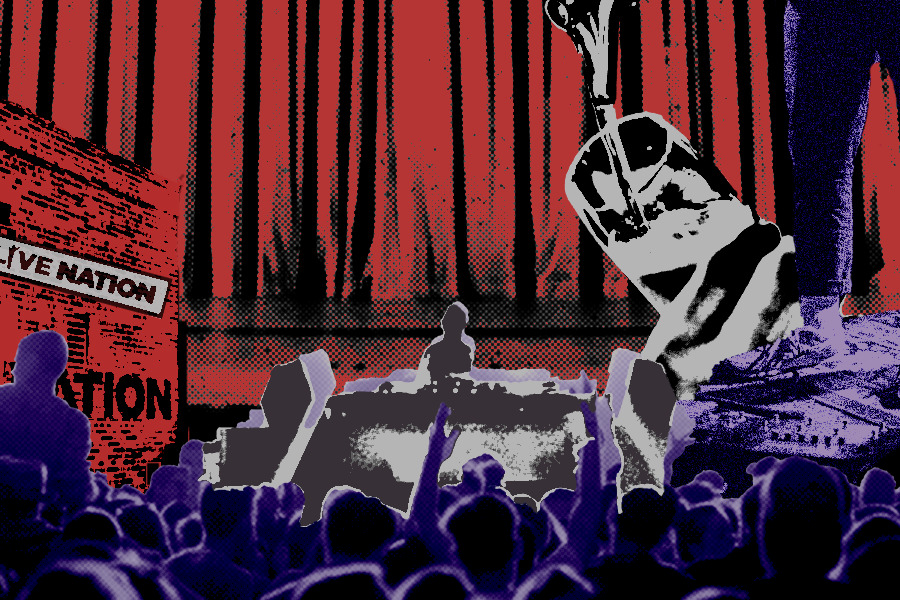

The O2 Academy venues in Edinburgh and Glasgow are ultimately controlled by the American events company, Live Nation, through various holding companies including one — Live Nation International Holdings B.V — registered in the Netherlands.

Ranked as the world’s fourth worst tax haven, the Netherlands has been described as the “undisputed European champion in facilitating corporate tax avoidance” by Oxfam.

Live Nation, the world’s biggest live events company, is incorporated in the small US state of Delaware, which is itself considered an internal US tax shelter.

The company also has a controlling stake in DF Concerts, the firm which organises and promotes the TRNSMT music festival and owns Glasgow gig venue King Tut’s, famous for helping to launch the career of Britpop band, Oasis.

The homogenising effects of these remote and disinterested ownership structures are therefore especially concerning when it comes to culture.

Chris Hayes, think tank Common Wealth

The Edinburgh Playhouse, and Glasgow’s King’s and Theatre Royal, are all part of the Ambassador Theatre Group (ATG) whose properties also include a number of venues in London’s West End.

ATG’s ultimate parent company is a firm in Luxembourg, which is itself controlled by two holding companies in the Caymans belonging to the US private equity giant, Providence Equity Partners.

The Cayman Islands are ranked as the second worst tax haven in the world by the Tax Justice Network, while Luxembourg is considered the sixth worst.

Three of Scotland’s biggest pub chains also have links to the Caymans.

Stonegate Group — the UK’s biggest pub group with nearly 4500 sites — is listed as an overseas company at Companies House and was incorporated in Grand Cayman.

Its ultimate parent, Stonegate Pub Company TopCo, is registered in Luxembourg, while its overall controlling party is a London-based private equity firm called TDR Capital.

Stonegate owns over fifty pubs in Scotland including venues in all of the country’s biggest towns and cities. It runs a number of brands which are popular in the rest of the UK and have sites in Scotland such as Slug and Lettuce cocktail bars, Popworld nightclubs, and the Australian-themed Walkabout bar chain.

The Suffolk-based brewer, Greene King, is the firm behind Belhaven pubs which owns hundreds of pubs found across Scotland’s high streets and communities. Greene King is owned by CK Asset Holdings Limited, which is registered in the Caymans and listed on the Hong Kong Stock Exchange.

Admiral Taverns, which markets itself as the UK’s “largest community pub group”, has a number of Scottish pubs in its estate. It is ultimately controlled by Proprium Real Estate, a US hedge fund, via a company called PSSF Brady (Cayman) Ltd which is incorporated in the Caymans.

‘Opaque’ ownership

Ronen Palan, a professor of international economy at City, University of London, called on the named firms to explain the “advantages” of setting up “opaque” and “costly” ownership structures that make use of jurisdictions like the Caymans and Luxembourg.

Palan said: “We have been hearing that offshore financial centres like the Caymans comply with the latest financial and fiscal regulations.

“Yet the owners of theatre or pub groups will still go to the trouble of creating ownership structures through these jurisdictions. What possible operational advantages can such opaque legal structures have?”

Chris Hayes, a senior analyst at the think tank Common Wealth, claimed that the “hoovering up” of pub and culture industry profits by tax haven corporations means that they are not reinvested in local communities. This leaves them in a “fragile and subordinate position”, Hayes argued.

“There’s a separate concern, which is that cultural life flourishes through variety, experimentation, and autonomy. It is foundational to any community’s distinctive identity, and necessary to make Scotland an attractive destination,” Hayes said.

“The homogenising effects of these remote and disinterested ownership structures are therefore especially concerning when it comes to culture.”

The Campaign for Real Ale also told The Ferret it was concerned about the “growing dominance” of “multinational companies, global brewers and investment firms” in Scotland.

Its chairman, Nik Antona, said that ownership by companies such as Greene King, Stonegate and Admiral “rarely bring benefits for licensees” and can “prevent fair competition and decent consumer choice”.

He added: “This trend can also put the future of pubs at risk of conversion to other uses like housing or shops if businesses are more interested in asset stripping than protecting local businesses and beloved pubs which are vital to their customers and communities.”

The Scottish Labour MSP, Paul Sweeney, called the involvement of firms with tax haven links in Scotland’s cultural sector “intolerable”.

Sweeney said: “With iconic venues like the Kings Theatre in Glasgow and the Edinburgh Playhouse included on the list of institutions owned by companies registered in tax havens, the scale of the problem becomes clear.

“If they were to shut up shop there would be a huge hole left in Scotland’s arts scene, and because of the structure of their ownership, there’s absolutely nothing anyone could do about it.”

This trend can put the future of pubs at risk of conversion to other uses like housing or shops if businesses are more interested in asset stripping than protecting local businesses and beloved pubs which are vital to their customers and communities.

Nik Antona, Campaign for Real Ale

All of the companies named by The Ferret have been asked to comment but only TDR Capital and Stonegate responded.

TDR Capital pointed out that it is based in England. It argued that Stonegate — which it owns — is resident in the UK for tax purposes and pays “all relevant UK taxes on its operations”.

A Stonegate spokesperson said: “Stonegate Group is a Cayman incorporated company and is a tax resident in the United Kingdom. The company files UK corporation tax returns on an annual basis as well as paying all UK employment tax and associated costs.”

Some of the other companies have also made statements about their tax arrangements in the past.

Live Nation’s website claims that the company sees “tax planning” as “necessary to mitigate tax risk”.

Its UK tax strategy reads: “Our approach is to ensure we are compliant and fulfil our tax reporting and payment obligations. We proactively manage tax risks to ensure that they do not unexpectedly impact our shareholder value after tax.”

ATG says it “complies with all tax regulations and disclosure requirements”. “The Group’s appetite for tax risk is low. Aggressive tax planning is not considered,”, it adds.

Greene King claims to pay between “£500-600m” of taxes and duties in a typical year. It adds that any tax planning is “reviewed in light of the Group’s obligations as a responsible UK taxpayer”.

Admiral Taverns did not respond to a request for comment and has not published its tax strategy.

All companies named as having tax haven links were approached.

Who Owns Urban Scotland is an investigation by The Ferret looking into the firms controlling Scotland’s towns and cities. Support our journalism by becoming a member for £5 a month at theferret.scot.