The future of pensions continues to be a heated issue within the Scottish independence debate.

Ferret Fact Service has fact-checked claims before about Scotland’s responsibility over existing state pensions if it left the UK, but a widely-shared graphic about how Scotland could cover them after independence has led to more confusion and dispute.

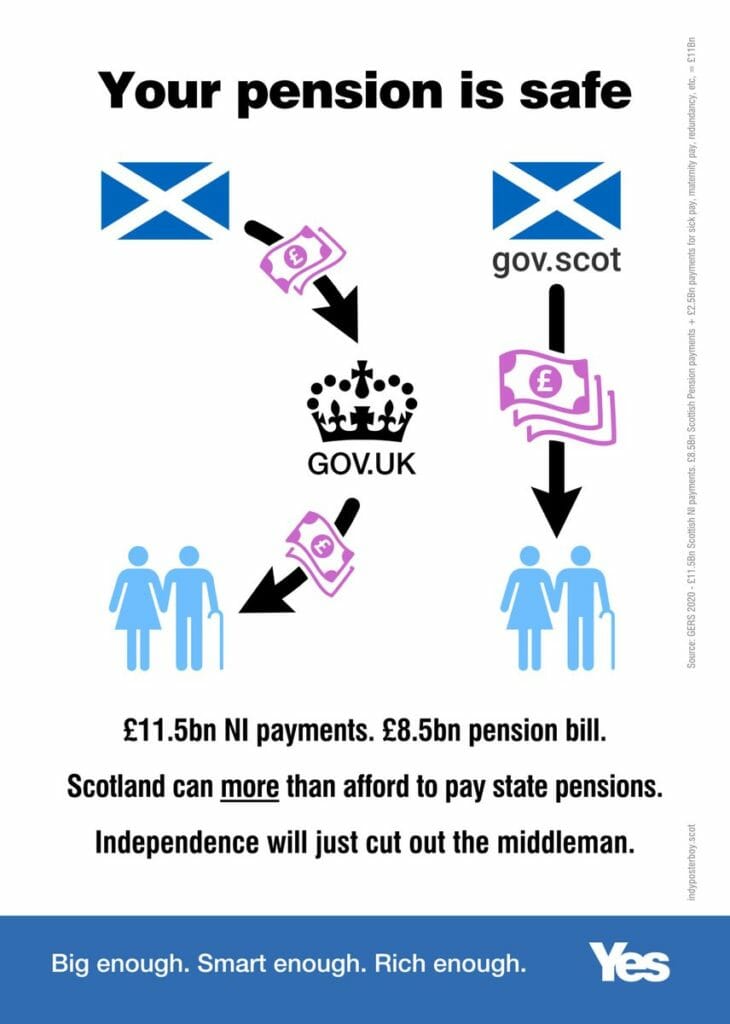

The image stated “your pension is safe” in an independent Scotland, and compared Scotland’s national insurance payments to the UK and its potential pensions bill.

This, the image claimed, showed Scotland could “more than afford to pay state pensions” and independence would “just cut out the middleman”.

Ferret Fact Service looked at this claim and found it to be Mostly False.

Evidence

State pensions in the UK are available to those who pay national insurance on reaching retirement age.

While the money used to pay for pensions is often referred to as a ‘pot’ or a ‘fund’, there is no reserved amount of money accumulated through a person’s life that then pays their state pension.

State pensions in the UK are paid by contributions from people who are currently working, so effectively people who are in-work are paying for the state pensions of those who have retired.

This means that the amount of money raised through national insurance can vary, and the UK Government can use money from other taxes to cover state pensions for those who have retired.

The widely-shared graphic compares the amount that people living in Scotland pay in national insurance (NI) each year, to the amount of money the UK Government currently spends in Scotland on pensions.

The figures it uses are accurate. According to the latest figures from 2020-21, Scotland’s NI contribution is £11.48bn, while an estimated £8.52bn is spent on paying for state pensions in Scotland.

National insurance is not just for state pensions

While estimates do suggest that Scotland pays more in NI contributions than it receives in state pension, national insurance is not only used to pay for the state pension.

UK taxes are not strictly ‘hypothecated’, which means taxes are not, by and large, raised to pay for specific services. Instead tax revenues are effectively pooled and then allocated to different spending requirements. A large share of national insurance contributions are used to pay for the state pension, but the tax also helps to pay for a number of other things.

A small proportion is used to cover other social security benefits, such as some unemployment benefits, and employment support benefits, as well as redundancy payments.

The most significant proportion of NI contributions that isn’t used for pensions is funding for the NHS. This funding is allocated to the NHS England before it reaches the National Insurance fund, and helps to fund Scotland’s NHS via the Barnett formula.

In 2020-21, the NHS allocation was £26.4bn. This made up about 19 per cent of the total raised through NI contributions.

Another smaller proportion is spent on administrative costs, as well as payments to Northern Ireland’s separate national insurance fund to ensure parity between the funds.

It is not possible to know for certain how an independent Scotland would pay for a state pension or arrange its tax system, which makes comparisons difficult.

Ferret Fact Service verdict: Mostly False

It is misleading to say Scotland’s national insurance contributions mean an independent Scotland could “more than afford” to take on state pension payments. It’s not known what arrangements could be made to pay state pension after independence, but while Scotland’s NI contributions are larger than its potential pensions bill, this does not take into account the other things that are currently paid for through national insurance, such as funding for the NHS.

Photo credit: iStock/vadimguzhva

This fact check has been updated to clarify how NHS money is allocated.