Pensions have formed an important part of the political debate in the UK in recent years, figuring in discussions around Scottish independence and Brexit.

The relative level of the state pension in the UK compared to the rest of the world has been regularly used as a criticism of the UK Government and an argument in support of Scottish independence.

One widely-shared and often repeated claim is that the UK pension is one of the worst in the developed world.

UK state pension is the worst in the developed world.

Social media and newspaper reports

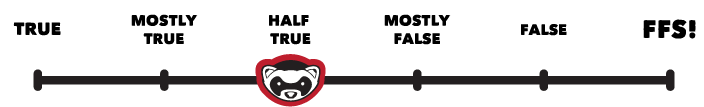

Ferret Fact Service looked at this claim and found it Half True.

Evidence

The full UK state pension is currently a flat-rate of £179.60 per week. This rate replaced the old state pension, which was in place for those who reached retirement age before 6 April 2016.

Pensions are currently reserved to Westminster, meaning decisions on the rate of pensions are made by the UK Government.

The claim that the UK’s state pension is the worst “in the developed world” has been around for some time, and is often accompanied by a bar chart showing the different pensions across the world. These claims are often based on a report by the Organisation for Economic Co-operation and Development (OECD), which publishes an annual look at pensions around the world. The OECD is made up of 38 countries.

Comparing pensions between different countries can be quite difficult because of “substantial differences in the structure of pension systems across the developed world”.

Research by the House of Commons library breaks the pensioners income into three broad types:

- state pensions and pensioner benefits (state-run schemes which are usually paid through taxation)

- occupational pensions (defined contribution or benefit schemes in workplaces)

- personal pensions (voluntary saving by individuals into private schemes)

What makes comparisons between different countries difficult is that they all rely on each type to a different extent. Many pensioners in the UK, for example, get a significant part of their income from occupational pensions and private schemes. This is less common in some other countries, so the level of state pension alone might not entirely reflect the overall income of pensioners in the UK relative to other countries.

There are also three main models for state pensions in different countries. They can be earnings-related, where the pension level is decided based on the tax contributions the person has made from their working salary.

Some countries use a form of means-testing, which guarantees a minimum pension amount but takes into account other income and assets.

Finally there is the flat-rate pension, where everyone is paid the same amount and entitlement is often based on a minimum number of contributing years and residency. This is the UK’s system, although the old state pension does have an earnings-related element, and various other benefits are also available for older people.

The OECD compares nations by the ‘pension replacement rate’, which looks at how much a pensioner would receive relative to their salary when they were working. So if someone who earned £30,000 a year while working received £24,000 a year from their pension in retirement, their pension replacement rate would be 80 per cent.

When looking at the latest figures from 2021, the UK’s gross pension replacement rate just using the mandatory state pension compares unfavourably to many other countries measured by the OECD at just 21.6 per cent.

But this does not reflect the amount of money that pensioners receive, as many workers in the UK are enrolled in occupational pension schemes. According to the UK Government, 88 per cent of eligible employees were participating in a workplace pension in 2020. These are considered by the OECD to be effectively mandatory as workers have to opt out of many schemes. When you include private schemes such as these, the UK’s gross pension replacement rate jumps to 49 per cent, which is about three percentage points under the OECD average.

The House of Commons library compared the UK’s state pension to similar European flat-rate systems in Ireland, Denmark and the Netherlands. The basic state pension amount was comparable to Denmark and each member of a couple in the Netherlands, but lower than Ireland by more than £30 per week. Each of these systems require a longer number of qualifying years to get the full pension amount than the UK does.

Perhaps a more important measure for those who are retired is the OECD’s net pension replacement rate as it “reflects their disposable income in retirement in comparison to when working”. The UK’s net figure in 2021 is 58.1 per cent. This figure puts the UK below the average of countries measured and slightly below the OECD average of 62.4 per cent, but above European countries such as Germany, Sweden, Norway, and Switzerland.

Another important measure of the impact pension schemes have are levels of pensioner poverty. The OECD defines this as those aged over 65 who have an income lower than half of the median household disposable income. In the UK, the OECD stats show 15.5 per cent of people over 65 live in relative income poverty. This is the 13th highest rate in the OECD and two percentage points higher than the OECD average.

Countries with higher levels of relative pensioner poverty include Switzerland, Israel and the US, while Germany, Italy, Spain and Austria are among those with lower rates.

The UK Government also produces figures on pensioner poverty which use a different methodology to the OECD, and show that after housing costs 11.6 per cent of over 65s are in relative poverty.

Ferret Fact Service verdict: Half True

The claim that the UK’s state pension is the worst in the ‘developed world’ is somewhat misleading. Comparisons between pension systems in different countries are difficult, as they rely to different extents on occupational and voluntary saving. While the UK’s mandatory state pension is among the lowest in the OECD, when combined with essential mandatory occupational pension schemes the UK is comparable to other European countries. However, pensioners in the UK face relatively high levels of poverty.

Ferret Fact Service (FFS) is a non-partisan fact checker, and signatory to the International Fact-Checking Network fact-checkers’ code of principles.

All the sources used in our checks are publicly available and the FFS fact-checking methodology can be viewed here.

Want to suggest a fact check?

Email us at factcheck@theferret.scot or join our Facebook group.

Photo thanks to iStock/Olga Shumitskaya