The Scottish Government announced changes to income tax rates in December last year.

Key to the new tax structure was the creation of an ‘advanced’ tax band affecting people’s earnings between £75,001 and £125,140 each year.

Since then, debate has swirled about the impact of the new tax rates, and a claim has been repeatedly posted on social media suggesting that two-fifths of Scots do not pay any tax at all thanks to being under the earnings threshold.

41 per cent of 16+ population in Scotland earn less than the personal allowance.

Reddit post

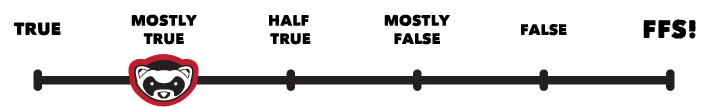

Ferret Fact Service looked at this claim and found it Mostly True.

Evidence

The claim on Reddit was accompanied by a table produced by The Times newspaper. It was widely shared across social media, including appearing numerous times on X (formerly Twitter).

It set out the number of adult Scots who fit into each tax bracket. The table referred to the 2023-24 tax year, before the advanced tax bracket was added.

The table states that 1.8 million people will pay no tax in Scotland in 2023-24 because they are under the personal allowance threshold, which is currently set at £12,570. Earnings under this threshold are not subject to income tax.

While the Scottish Government can set different tax bands to the rest of the UK, the personal allowance is reserved to Westminster.

The statistics that the claim is based on come from a Scottish Government analysis of Scottish income tax rates the previous year – 2022-23.

In that year, 41 per cent of Scots aged 16 or over did not pay income tax. In 2023-24, the figure was 39 per cent.

The report estimated there would be 4.6 million adults living in Scotland in 2022-23, of which about 1.9 million, or 41 per cent will not pay income tax.

Why do so many adults not pay income tax?

The majority of Scottish taxpayers – 71 per cent – are between 25 and 64. This is because many young people are still in full-time education, while many people 65 and over are likely to be receiving pensions, and may have incomes that are lower than the personal allowance. Pensions are still taxable, but incomes tend to reduce as people stop working.

In Scotland, incomes tend to peak for middle aged people.

Twenty per cent (1.1 million) of Scottish adults are 65 and over, while around half a million are between 16 and 25.

Scotland’s population is ageing with the over 65 population growing significantly faster than that of young people.

About 75 per cent of Scots aged between 16 and 64 are in work, according to the latest labour force statistics.

How does this compare to the rest of the UK?

The Scottish figure is broadly similar to the rest of the UK. According to the Institute for Fiscal Studies (IFS), about 36 per cent of adults in the rest of the UK pay no income tax due to being under the threshold in the personal allowance, or because they are not working.

While only around 64 per cent of the population across the UK have income high enough to pay income tax, more people than this are impacted by changes to tax rates, as many live in a family where someone pays income tax or will pay income tax at some point in their life.

Ferret Fact Service verdict: Mostly True

These statistics are broadly accurate, although a year out of date. Scotland’s percentage of adults paying income tax is broadly comparable to the rest of the UK. There are a number of reasons for the large minority of the population not paying income tax. But it appears to be linked to someone’s age, with under 25s and over 65s more likely to be under the threshold due to not being in full-time employment. Older people are likely to be retired and under 25s more likely to be in education.

Ferret Fact Service (FFS) is a non-partisan fact checker, and signatory to the International Fact-Checking Network fact-checkers’ code of principles.

All the sources used in our checks are publicly available and the FFS fact-checking methodology can be viewed here.

Want to suggest a fact check?

Email us at factcheck@theferret.scot or join our Facebook group.