The latest paper on the Scottish Government’s plan for independence has been released with the first minister setting out part of the economic plan.

In a press conference announcing the new white paper, Nicola Sturgeon faced questions from the media about the Scottish Government’s finances and the economic case for independence.

Responding to a query about public sector pay, Sturgeon argued that Scotland’s budget limited the amount of assistance the Scottish Government could give.

“We have, effectively, a fixed budget”.

Nicola Sturgeon

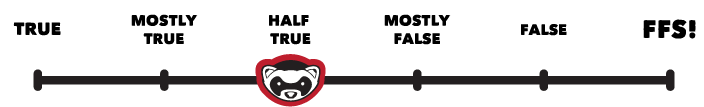

Ferret Fact Service looked at this claim and found it Half True.

Evidence

The Scottish Government budget is made up of a few different parts. It’s published each year, detailing changes in the funding for departments, as well as any changes to tax bands or benefits. The budget document also sets out new taxes, benefits and public services.

However, Scotland can only set its budget in line with the powers which are devolved to the Scottish Parliament.

There are specific powers reserved to the UK parliament at Westminster, such as defence, immigration, currency, many social security payments, and most economic policy.

This means that the Scottish Government has limitations in what it can do within its budget.

How is the Scottish Government budget funded?

The largest slice of funding that makes up the Scottish budget comes from the block grant.

The block grant is a sum of money that is given to the Scottish Government by the UK Government, and mostly made up of taxes collected throughout the UK.

There are two main parts to the block grant: the baseline grant, which is equivalent to the grant the previous year, and the Barnett consequential.

The Barnett consequential is the amount of money that comes to devolved nations as a result of changes to spending in England. This change is added up and Scotland is given a share of it based on its population size.

The Barnett formula also takes into account the powers Scotland has over each public service. This is to make sure that changes to spending in England lead to the same spending per person in Scotland.

If a service is 100 per cent devolved, then the amount of money that comes to Scotland should be the same, per person, as in England, but if some of the service is covered directly by the UK Government then the amount can be less, to account for spending that the UK Government is responsible for. This is called the ‘comparability’ factor.

This part of the budget is effectively fixed by the spending of the UK Government in England. The Scottish Government cannot alter the block grant, however it can spend the money in whatever way it chooses to prioritise certain issues.

What about taxes?

The second largest part of the budget is from taxes. Scotland receives funding from fully devolved, partially devolved and assigned taxes.

Fully devolved taxes include council tax, non-domestic rates, and land and buildings transaction tax (LBTT).

Scotland also has partial powers over income tax. Revenues raised from income tax in Scotland go to the Scottish Government, and Scotland can set its own rates of income tax each year. However, the UK Government retains power over some aspects of income tax, such as setting the personal allowance (the amount of money you can earn without it being taxed).

Scotland has the ability to set and collect new taxes, and has been devolved power over further UK taxes, such as the air departure tax (ADT), which is planned to replace air passenger duty (APD)

For taxes which are devolved a calculation is done to adjust the block grant. This deducts money from the block grant to account for the reduction in revenues for the UK Government from the tax, by calculating the amount that would have been raised had the tax not been devolved. This means that changes to tax made by the Scottish Government are realised in the Scottish budget.

These block grant adjustments are also made for devolved parts of social security spending, except this time they are added to the block grant rather than deducted, to take account of the reduced spending requirement of the UK Government.

Can the Scottish Government borrow to fund spending?

One area where the Scottish Government is limited in its budget is borrowing. It cannot borrow for increases in spending on public services, unless it is to cover budget gaps based on errors in forecasting, or for cash management.

This is limited to £300m per year and £500m a year respectively, rising to £600m if there is a specific Scotland-based economic shock. Scotland can also pay into a reserve when revenues are higher than forecast.

Scotland can borrow for capital spending – investment in assets and infrastructure projects, rather than day-to-day spending that keeps services running – up to £450m in a year.

This is a relatively small amount of money when compared to the level of overall UK Government borrowing, which was £72bn in the first half of 2022-23.

Ferret Fact Service verdict: Half True

The largest part of Scotland’s budget – the block grant – is effectively fixed. The block grant is affected by changes to UK Government spending in England, which then filters through to the Scottish Government. However, the budget in Scotland can be altered each year by devolved and partially-devolved taxation, such as council tax and the Scottish rate of income tax. The Scottish Government has limited borrowing powers.

Photo credit: Pool/Fraser Bremner/Scottish Daily Mail