Authoritarian regimes and financial giants with stakes in the fossil fuel industry are among investors who would benefit from plans to use hydrogen to heat UK homes, which critics say could increase fuel poverty.

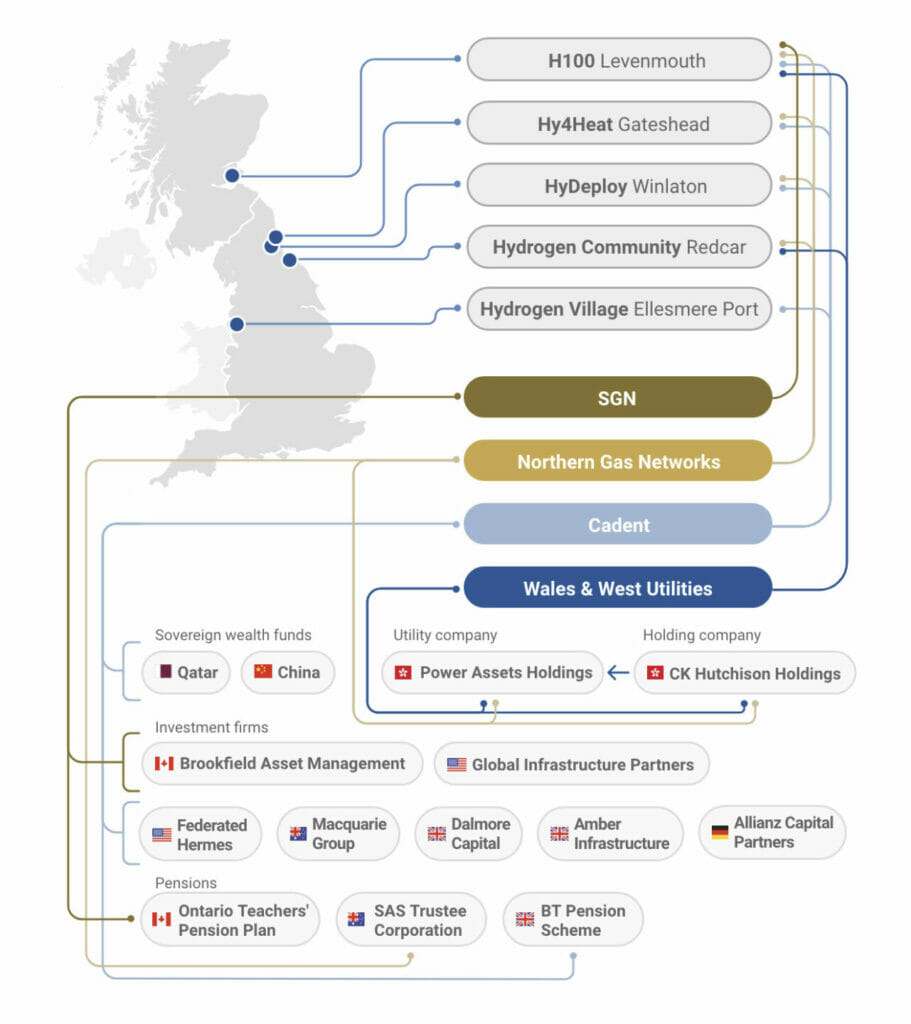

The findings come from a Ferret analysis of shareholders in Britain’s four gas distribution companies – who are spearheading the push for hydrogen heating as a greener alternative to natural gas.

We found shareholders in these gas firms include the Chinese and Qatari governments, an Australian bank nicknamed the “Vampire Kangaroo” for its tough pursuit of profit, and a New York private equity company whose managing director advised Donald Trump during his presidency.

The gas distribution networks are valuable assets for these investors. Our investigation found that together they paid out nearly £2.4bn to shareholders in the last five years.

Using hydrogen for heating is controversial. Concerns have been raised about its efficiency, high costs to consumers, and the fact the majority of UK hydrogen is still produced from natural gas.

Some critics have claimed the technology is being pushed by ‘vested interests’ who fear that their gas industry investments will become stranded assets if there is a widespread switch to heat pumps rather than hydrogen. Heat pumps run on electricity meaning that gas pipelines would become obsolete.

Campaigners claimed The Ferret’s findings showed the “not-so-hidden” agenda of the UK gas networks is to “keep making profit out of those networks when the UK finally gives up on fossil gas”. “Hydrogen for heating looks more and more like a corporate con designed to protect the assets of global financial players rather than deliver any real climate action,” one activist claimed.

The trade body that represents the UK’s gas networks said that “industry, businesses and many homes can only be decarbonised if hydrogen is part of the energy mix”. The Energy Networks Association said dividends paid to investors by the gas networks were “within the regulatory guidelines set by Ofgem”.

The gas networks are behind hydrogen trials of varying sizes across Britain, aimed at proving the viability of the technology ahead of UK Government decision about the future of domestic heating, which is due in 2026.

SGN

SGN owns the gas distribution network in Scotland and in much of the South East of England.

SGN is the company behind the H100 project, a ‘world-first’ trial of hydrogen heating systems at 300 homes in Levenmouth on the Fife coast.

The project will use green hydrogen produced by a nearby wind turbine to power the homes and is expected to get underway by the end of 2024.

Northern Gas Network, Cadent and Wales & West Utilities are partners in the project.

SGN has paid out a combined £740m to its shareholders in the last five years including £84m in 2022 despite the wider company making a post-tax loss of £187m last year.

Three quarters of shares are owned in equal parts by two Canadian investment giants, 🇨🇦Brookfield Asset Management and the 🇨🇦Ontario Teachers’ Pension Plan.

The remaining 25 per cent is owned by the New York-based private equity firm, 🇺🇸Global Infrastructure Partners (GIP).

Brookfield has investments in major fossil fuel infrastructure projects including in the oil sands and coal sectors.

The UN climate envoy and former Bank of England governor, Mark Carney, is chair of Brookfield Asset Management as well as its head of transition investing.

He was quizzed on the firm’s investments in polluting industries by a Westminster committee last year, after The Ferret revealed Brookfield is the ultimate owner of a crucial vessel which will enable oil production at a project called Rosebank in the North Sea if it is approved by the UK Government. Rosebank is the biggest untapped oil field in UK waters and plans to develop it have been the subject of intense opposition from climate activists.

The OTPP held just under £2.7bn of oil and gas investments in its portfolio in 2020 and as well as holding a stake in SGN, it also has a 15.8 per cent share in Puget Sound Energy – a gas distribution company in the US state of Washington.

GIP owns stakes in Edinburgh and Gatwick airports and has investments in fossil fuels.

It was part of a consortium that bought a 49 per cent stake in the Abu Dhabi’s national oil company’s gas pipeline business in 2020. It also has a major stake in a huge new natural gas extraction project in Australia. GIP’s founder and managing director, Adebayo Ogunlesi, served on Donald Trump’s business advisory council when he was US president.

Northern Gas Networks (NGN)

NGN delivers gas to 2.7 million customers in the North East of England, Northern Cumbria and much of Yorkshire.

NGN is competing with Cadent for funding from Ofgem’s hydrogen village competition.

Its Hydrogen Community trial would power 2,000 homes in Redcar on Teesside with 100 per cent hydrogen.

Ofgem will announce later this year whether it or Cadent’s Hydrogen Village will go ahead.

NGN, together with Cadent, also built two demonstration homes in Low Thornley in Gateshead which showcased hydrogen heating appliances for the Hy4Heat project. NGN and Cadent have already trialled blending of 20 per cent hydrogen with natural gas in trials at Keele University and Winlaton in the North East of England as part of the HyDeploy programme.

NGN is a partner in SGN’s H100 project.

NGN has paid out £402m to its shareholders in the last five years despite only making a profit of £284m in that period.

In 2022 it paid out £74m in dividends despite the wider company making a £70m post-tax loss.

NGN is almost entirely owned by two Hong Kong-based investors – 🇭🇰CK Hutchison Holdings (47 per cent) and 🇭🇰Power Asset Holdings (41 per cent).

The same two companies own all of Wales & West Utilities.

The remaining 12 per cent is owned by 🇦🇺SAS Trustee Corporation, also known as State Super, the pension scheme for public servants in the Australian state of New South Wales.

CK owns stakes in two gas transmission companies in Australia, as well as a gas pipeline in the country. It is also an investor in electricity networks, including in the UK, and the firm co-owns SSE’s Seabank gas-fired power station in Bristol.

Power Assets is itself partly owned by CK Infrastructure, which holds nearly 39 per cent of Power Assets.

Power Assets has investments in 500,000km of electricity and gas transmission networks in countries including Australia, Canada and Thailand. It also has stakes in power generation, including coal-fired power plants. It was named by the UN as one of the 166 companies collectively responsible for 80 per cent of global greenhouse gas emissions.

SAS Trustee Corporation has stakes in the highly-polluting global aviation industry including Melbourne airport. It holds a 40 per cent stake in Queensland’s AllGas distribution company in Australia.

Cadent

The UK’s largest gas distributor which owns more than 82,000 miles of pipes transporting gas through areas of the North West, Yorkshire, the Midlands, and North London.

Cadent is competing with Northern Gas Networks for funding from energy regulator Ofgem’s hydrogen village competition.

Its Hydrogen Village project is a partnership with British Gas and would see 2,000 homes in the town of Whitby in Merseyside powered with 100 per cent hydrogen.

Ofgem will announce later in 2023 which of the two trials will go ahead in 2025.

Cadent is a partner in SGN’s H100 project. Together with NGN, it built two demonstration homes in Low Thornley in Gateshead which showcased hydrogen heating appliances for the Hy4Heat project and trialled blending of 20 per cent hydrogen with natural gas in trials at Keele University and Winlaton in the North East of England as part of the HyDeploy programme.

Cadent has paid out over £1.2bn in dividends to its shareholders in the last five years despite the fact it has lost over £2.1bn in that period.

It paid out £135m in dividends in 2022 despite losing £473m last year.

The Australian bank, 🇦🇺Macquarie, owns 26 per cent.

The 🇨🇳Chinese and 🇶🇦Qatari governments own 17 and 8.5 per cent of Cadent, respectively.

Other shareholders are Scottish firm, 🇬🇧Dalmore Capital (14 per cent), an investment arm of German insurance giant, 🇩🇪Allianz (13 per cent), American investor, 🇺🇸Federated Hermes (9 per cent), International Public Partnerships, managed by 🇬🇧Amber Infrastructure Group (7 per cent), and the 🇬🇧BT Pension Scheme (5 per cent).

Macquarie has been described as the “Vampire Kangaroo” because of its tough pursuit of profit – a moniker it rejects – and is a major shareholder in Aberdeen and Glasgow airports, the National Grid electricity transmission system, and the M6 toll road.

China produces more climate pollution than any other country in the world and its overall approach to tackling climate change has been rated as “highly insufficient” by independent analysts. Its emissions increased by 3.4 per cent in 2021 a year when its annual production of coal – the dirtiest fossil fuel and a leading cause of global warming – reached its highest ever level.

Meanwhile, Qatar is a global leader in the production of natural gas and is aiming to expand its production of fossil fuels – with potentially “catastrophic” impacts on the climate – in the coming years.

Wales and West Utilities (WWU)

Wales and West own 35,000 kilometres of gas pipes across Wales and in England’s West Country.

WWU is not leading any of the main hydrogen heating trials taking place in the UK but is a partner in SGN’s H100 project and NGN’s budding Hydrogen Community project.

Last year it announced plans for HyLine Cymru, a major hydrogen pipeline in South Wales which would provide industry and gas customers with “low carbon” hydrogen. It said this pipeline could “facilitate the conversion of home heating to hydrogen; enabling south Wales towns to go green”.

Wales and West has not paid dividends to its shareholders over the last five years, a period in which it has made an overall post-tax loss of £275m.

🇭🇰CK Hutchison Holdings owns 70 per cent, while 🇭🇰Power Asset Holdings owns 30 per cent.

CK owns stakes in two gas transmission companies in Australia, as well as a gas pipeline in the country. It is also an investor in electricity networks, including in the UK, and the firm co-owns SSE’s Seabank gas-fired power station in Bristol.

Power Assets is itself partly owned by CK Infrastructure, which holds nearly 39 per cent of Power Assets.

Power Assets has investments in 500,000km of electricity and gas transmission networks in countries including Australia, Canada and Thailand. It also has stakes in power generation, including coal-fired power plants. It was named by the UN as one of the 166 companies collectively responsible for 80 per cent of global greenhouse gas emissions.

‘Not-so-hidden agenda’

According to Dr Richard Lowes, an expert in sustainable heating from the University of Exeter, “the role of hydrogen in heating looks extremely limited and these companies have the same information I do so clearly their lobbying and PR strategy is primarily about protecting their own interests.”

Lowes told The Ferret: “When the energy industry was privatised, mass foreign ownership was not the intention and the fact that these asset owners are now lobbying the British state is alarming from a sustainability and energy security perspective.”

Alex Lee, a climate campaigner at Friends of the Earth Scotland (FoES), agreed. “It is hard to believe these organisations are acting in the interests of the climate when you see the fossil fuel infrastructure and polluting airports that are also on their books,” she said.

“The scientific evidence has shown for some time now that using hydrogen to heat our homes would be a costly and inefficient plan that serves only to prolong the lifetime of fossil fuels and their infrastructure such as gas pipelines.

“Hydrogen for heating looks more and more like a corporate con designed to protect the assets of global financial players rather than deliver any real climate action.”

FoES’ former director and freelance environmental campaigner, Dr Richard Dixon, said our research revealed the “strong fossil fuel interests behind the push for hydrogen”.

“The not-so-hidden agenda of the companies who own gas networks is to keep making profits out of those networks when the UK finally gives up on fossil gas,” Dixon argued.

“They clearly see the use of hydrogen made from natural gas as the way to prolong the life of their fossil fuel investments, even though climate change means the world instead needs to exit fossil fuels as quickly as possible.”

Sarah Bierman Becker, fossil fuel campaigner at Global Witness, said it was “depressing but sadly not surprising to learn of the toxic financial interests behind some of the UK’s biggest hydrogen proponents”.

Bierman Becker added: “The global drive for hydrogen, which the UK seems to be at the forefront of, is coming squarely from a fossil fuel industry overwhelmingly responsible for the climate crisis.

“Hydrogen is a way for those companies to do the same toxic practices that have brought the world to the brink of disaster, hidden behind a phoney green PR spin.”

A spokesperson for Energy Networks Association, which represents all four UK gas distribution companies, said: “Industry, businesses and many homes can only be decarbonised if hydrogen is part of the energy mix, alongside electrification.

“That’s why it’s essential that we rule nothing out as we continue to deliver the government’s plan for decarbonisation. This will also create choice for customers in the type of energy they use.

“Any dividends paid to investors are within the regulatory guidelines set by Ofgem and have to meet strict rules to ensure businesses are sustainable and creditworthy.”

Northern Gas Networks argued that there is “no one-size-fits-all” solution to cleaner heating and decarbonising homes will only be achieved if “all technologies are in play”.

“With 85% of UK homes connected to the gas grid, it’s vital we explore how it can be converted to transport clean hydrogen to deliver on the government’s plan for decarbonisation by 2050.

“This will ensure customers can continue to benefit from choice in the type of energy they use in their homes, and a secure, resilient network.”

SAS Trustee Corporation said: “We invest in a variety of infrastructure assets in accordance with our commitment to net zero for our portfolio by 2050.

“As an investor, we are committed to influencing NGN on the path to using green hydrogen. State Super understands converting NGN’s existing gas network to operate using green hydrogen is an effective energy transition and energy security by using existing infrastructure for the transition rather than having to re-invest capital in a new electricity transmission network.”

The Ferret has contacted all of the investors named in this story for comment.

The Ferret has received funding from the Global Strategic Communications Council, a collaborative project hosted by the European Climate Foundation, to investigate the roll out of hydrogen technology in Scotland. The Ferret maintains complete editorial independence.

Featured image credit: iStock/jaochainoi

What a ridiculous story. Of course energy investors are going to be behind the move. The same companies are already developing and operating offshore wind farms and EV chargers. They own the existing infrastructure and have all the necessary expertise and resources to develop the transition from fossil fuel to green hydrogen. The cost will be a function of future electricity prices and the quantity of excess electricity supply that can be generated from renewable sources.