The UK announced that armed forces personnel would be compensated for tax changes brought in by the Scottish Government.

In a statement in July, defence secretary Gavin Williamson announced “an annual payment to make sure that all troops, regardless of where they are deployed or where their families are based, will pay the same income tax”.

However, supporters of the Scottish Government questioned the number of people that had been affected, after the UK government claimed around 8,000 would be compensated.

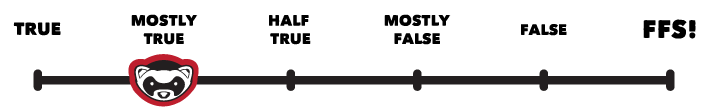

Ferret Fact Service looked at this claim, and found it to be Mostly True.

Evidence

The controversy around the impact of the tax changes on the military stationed in Scotland has remained a talking point since the new tax bands passed through the Scottish Parliament in February.

Prominent Conservative politicians, including Douglas Ross MP, claimed that the new system would see armed forces personnel paying more tax in Scotland than England once they earned over a certain amount.

Ferret Fact Service found this amount to be around £26,000, at which point the new 21 per cent tax band would see more tax being paid north of the border.

This is down to the increase in the personal allowance – the amount of income you don’t pay tax on – from £11,500 to £11,850. The allowance is still set by the UK government. It is also affected by the new lower earners’ rate.

Claim that military earning over just £24,000 will pay more tax in Scotland is False

The Scottish Rate of Income Tax (SRIT) added two more levels to the three-band system previously in place across the UK. The new arrangement reduces the amount of tax paid by low earners, but increases it for higher earners.

A starter rate of 19 per cent will cover those earning between £11,850 and £13,850. The standard 20 per cent will be paid by those earning above that up to £24,000.

Between £24,000 and £43,430, there is an intermediate rate of 21 per cent. Higher earners up to £150,000 pay a 41 per cent tax, while those earning more than that pay 46 per cent.

When the UK government announced the compensation package for those affected, they claimed that around 8,000 people would benefit.

This was widely disputed, with many suggesting that the UK government figure had been inflated to overstate the impact of the Scottish Government’s tax system.

To find out, The Ferret sent a freedom of information request to the Ministry of Defence to find out how many service personnel were earning over the £26,000 threshold for paying more.

The 8,000 figure mentioned in the UK government statement comes from an analysis of the wages of full time personnel stationed in Scotland in the last financial year (2017-18, up until 1 April).

According to the response, there were 10,340 military personnel based in Scotland, while there are 133,600 across the rest of UK.

if(“undefined”==typeof window.datawrapper)window.datawrapper={};window.datawrapper={},window.datawrapper.embedDeltas={“100″:637,”200″:551,”300″:551,”400″:535,”500″:535,”700″:535,”800″:535,”900″:535,”1000”:535},window.datawrapper.iframe=document.getElementById(“datawrapper-chart-Nq26I”),window.datawrapper.iframe.style.height=window.datawrapper.embedDeltas.iframe.offsetWidth/100),100))]+”px”,window.addEventListener(“message”,function(a){if(“undefined”!=typeof a.data)for(var b in a.data)if(“Nq26I”==b)window.datawrapper.iframe.style.height=a.data+”px”});

The majority of the Scottish-based personnel were earning above the £26,000 threshold. According to the rounded figures provided, this would mean that 7,340 required mitigation from the UK government. This is 660 lower than the approximate figure given in the compensation statement, but is broadly similar to the estimate given.

The figures also show that there are around 37,720 personnel stationed in the rest of the UK who earn less than £26,000 per year. These people would pay slightly more income tax than the 3010 service men and women earning less than £26,000 per year who are based in Scotland.

As the MoD notes, it is not possible to give an exact figure of the number affected until the end of the current tax year when military payroll will be completed.

Ferret Fact Service verdict: Mostly True

The estimate given by the Conservative government for the number of military personnel affected by the Scottish Government’s tax changes was broadly accurate. The figure comes from an analysis of salaries in the military based in Scotland in the last financial year. It is not possible to get an exact figure who are affected until the end of the current year.

This factcheck was updated on 28/03/2019 to provide more clarity on the numbers of lower-paid service personnel based outside Scotland.