Weapons manufacturers, the oil giant Shell, and financial institutions which poured billions of pounds into fossil fuels are among firms buying Scottish carbon credits, prompting critics to claim the country is experiencing an era of “rampant carbon capitalism”.

Land reform experts have told The Ferret that demand for space to produce the credits and sell them to major firms looking for a quick way to reduce their emissions is contributing to soaring rural land prices across the country. This is preventing local communities from seeing the economic benefits of work to restore nature in their area, they claimed.

The credits – which theoretically ‘offset’ climate pollution created by other parts of the firms’ UK businesses – were produced by Scottish tree planting and peatland restoration projects aimed at absorbing carbon dioxide (CO2) from the atmosphere.

Carbon credits are viewed as one of the key corporate solutions to the climate crisis. Supporters claim that because they put a value on carbon reductions, the credits lure private money to nature restoration projects. They also argue that they help companies compensate for emissions which they are currently unable or unwilling to reduce or get rid of.

Scotland is attractive to developers of the credits because of its large rural land area, lightly regulated land market, and lucrative government subsidies for woodland and peatland projects.

But green groups have branded them a “false solution” to the climate crisis. They claimed that instead of being used to offset “hard-to-tackle” pollution, they are being bought by firms who want to “dodge the need to transform their carbon intensive practices”.

One campaigner argued that very few Scots would agree that “Scottish trees should be helping arms companies keep on pumping out climate pollution”.

The Scottish Government – which has encouraged the use of Scottish land for the creation of carbon credits – said it was “fully committed to tackling the adverse effects of scale and concentration of land ownership”. It added that private investment is “critical” to “enabling the scale and pace of action required” to tackle climate change and restore nature.

The Ferret’s report is the second in a two-part special into Scottish carbon credits. Yesterday we revealed that BP and the country’s richest man are among the firms buying up rural land to cash in on the ongoing ‘green rush’.

The buyers

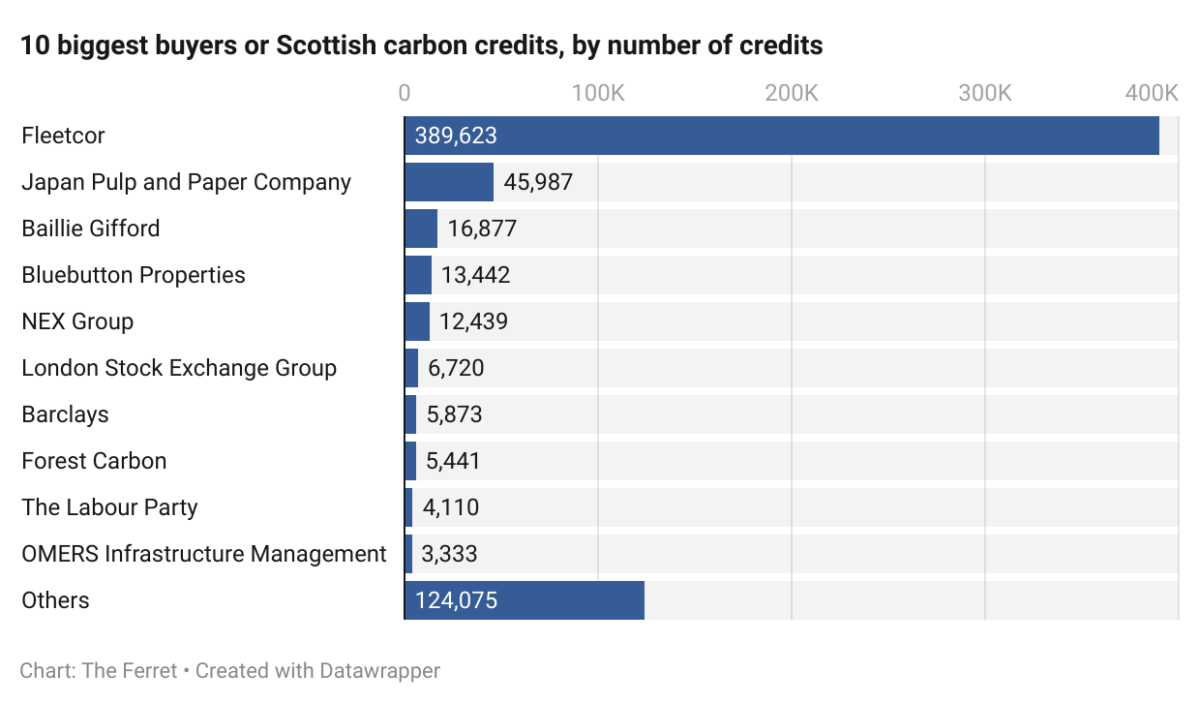

The findings come from exclusive analysis by The Ferret which looked at all the buyers of credits from carbon capture projects in Scotland listed on the public registries of the Peatland (PC) and Woodland (WC) Codes. The PC and WC are the two carbon credits schemes currently operating in Scotland.

Nearly 560,000 credits produced by Scottish projects have been sold to date. Each credit permits a firm to emit one tonne of CO2 because the equivalent amount has supposedly already been absorbed by a Scottish woodland or peatland project.

It seems unlikely that many people would think Scottish trees should be helping arms companies keep on pumping out climate pollution.

Richard Dixon

By far the biggest buyer is an American firm called FleetCor, which sells fuel cards to the haulage industry. It has bought nearly 390,000 credits from Scottish woodland projects – more than half of those sold so far – for a scheme for UK customers called EcoPoint which allows them to offset some of their emissions.

The firm markets the offset scheme as an affordable alternative to decarbonising for its clients. According to its website, “upgrading your fleet to zero emissions is expensive” whereas EcoPoint is an “affordable way to mitigate your businesses’ environmental footprint and appeal to more customers”.

Banks, insurance companies and major investors have also bought nearly 30,000 credits to offset the climate impact of their UK operations.

Among them are Barclays – which has invested over £100bn in oil and gas firms since the Paris Agreement was signed in 2015 – and Baillie Gifford, which also has fossil fuel investments and a major stake in one of the North Sea’s biggest oil producers.

Shell bought 635 credits to offset a small part of the emissions produced by a rewards scheme for motorists. All of the credits Shell has bought were produced from woodland projects developed on land owned by Buccleuch Estates – one of Scotland’s biggest landowners.

Thales – which produces weapons including unmanned drones – has bought 2,735 credits.

The French firm’s Glasgow factory was stormed by pro-Palestinian protestors in July. They claimed it was a “vital link in Israel’s military supply chain”. Thales is also working with fellow arms manufacturers, Raytheon and Lockheed Martin, to expand Nato’s ballistic missile defence capability.

Thales is one of two arms industry firms among the top twenty buyers of Scotland’s carbon credits. The other is Babcock, which bought 1,322 credits to offset emissions produced by a fleet of non-combat vehicles it runs on behalf of the UK Ministry of Defence.

Why are the credits controversial?

Carbon credits have been branded as a “false solution” to the climate crisis by green groups.

They have pointed out that projects will sometimes take decades to capture the amount of emissions that a carbon offset scheme promises. Because emissions are cumulative, pollution which enters the atmosphere while the woodland or peatland project is developing will still contribute to global warming.

Capturing carbon through planting trees – which is still by far the most popular method of producing carbon credits in Scotland – is also not the same as capturing it underground. If the trees die or are damaged then the carbon that they hold will be released back into the atmosphere.

Offsets would also require an enormous amount of land to make a dent in global emissions.

According to Oxfam, trees would need to be planted across land five times the size of India if the world is to meet net-zero emissions by 2050 – the stated goal of the Paris Agreement – through tree planting alone.

Including credits which have not been sold on the carbon market, Scottish carbon projects listed on the WC and PC so far will absorb an estimated 14 million tonnes of CO2 across their lifetime. Despite requiring a land area bigger than Scotland’s three biggest cities to produce, this would account for just one per cent of the emissions that Shell alone produces in just one year.

Although their true environmental benefits remain dubious, the international market for carbon credits is expected to explode by 2050, when it is expected to be worth $100bn in the UK alone.

This is already being reflected in a massive increase in demand for Scottish land for offsetting purposes by big private investors.

Read more of The Ferret's coverage of Scottish environmental issues here

According to Magnus Davidson, who researches the rural environment and economy at the University of the Highlands and Islands, this demand is being driven by “increased government support for environmental measures and a rise in interest from corporate buyers with large balance sheets”.

“The average price last year of a Highland estate, those being bought for carbon offsetting, rose to £8.8m, an increase of 87% on the year before. Seven sold for over £10m”, Davidson said.

“The changing land market has ramifications for communities across Scotland. Those wishing to buy land find it harder to raise the capital to do so.

“With a company like Fleetcor this is exactly what we do not want to see. These emissions are entirely avoidable, these Scottish carbon credits are being used to allow UK vehicle fleets to burn more fossil fuel.

“Carbon offsets are not inherently bad, we do and will need them as a mechanism to sequester some emissions. They can also be used to benefit communities in numerous ways, not least financially. But what we have right now is rampant carbon capitalism, exploiting public subsidy, concentrated land ownership, and poor regulations.”

Dr Richard Dixon, the former director of Friends of the Earth Scotland, claimed that the “list of clients” for Scottish carbon credits was “pretty surprising”.

Dixon added: “It seems unlikely that many people would think Scottish trees should be helping arms companies keep on pumping out climate pollution.

“Buying credit for trees being planted can just be an excuse for not trying harder to reduce emissions from a company's own operations.

“As the last few weeks have shown, the unpredictable weather conditions that climate change brings may mean that the carbon locked up in these trees is not as secure as you might hope, making buying offsets like these even more uncertain.”

Meanwhile, Peter Peacock, the former convener of Highland Council, argued that the carbon credit market is “highlighting and accentuating wealth inequality in Scotland”.

Peacock said: “We are going to need all our land in Scotland to manage our own residual emissions after taking all available emissions reducing actions. A more social model of land ownership is needed to both share the wealth creating potential of this market and to utilise it for our own emissions.

“The more Scottish carbon credits are sold to offset the emissions of international firms, the less we will have available for our own needs.”

The former Scottish Environment Protection Agency chief executive, James Curran, said: “Carbon sequestration was always intended to offer the opportunity to offset recalcitrant, or hard-to-tackle, emissions, as Scotland approaches net zero in 2045.

“But this scheme allows the carbon credits to be sold throughout the UK. The majority will then be bought in England and used by businesses based there, and they could be branches of globally-delinquent companies, to dodge the need to transform their carbon intensive practices.

“There is no obligation to involve local communities and to offer those communities a real stake, financial or otherwise, in forestry creation – as is expected with wind farms for example. This undermines the principles of true sustainability.”

A Scottish Government spokesperson said: “Scottish Ministers are fully committed to tackling the adverse effects of scale and concentration of landownership – and empowering communities in the process. That is why, this summer, we are consulting on a wide range of proposals for our ambitious new Land Reform Bill, which will be introduced by the end of 2023.

“The Scottish Government has significantly increased investment in nature restoration in recent years, but the size of the challenge is huge, which means that increasing private investment will be critical to enabling the pace and scale of action required to restore our natural environment and tackle climate change.

“Earlier this year, we published a set of interim principles on private sector investment in natural capital to help us to focus investment in the right types of natural capital in the right places."

Scottish Land and Estates, which represents the landowners that produce Scottish carbon credits, told The Ferret that private investment in tree planting and peatland restoration were leading to “significant land use change” and were “not a short-term money making enterprise”.

A Shell spokesperson said: “Shell expects to build low-carbon businesses of significant scale over the coming decade, such as in biofuels, EV charging, hydrogen and renewable power, as well as carbon capture and storage. But offsets are a vital solution for balancing emissions that cannot yet be abated.

“We aim to use them in line with the philosophy of avoid emissions, reduce emissions and only then to mitigate them, with any offsets we use being of the highest independently verified quality. As part of our selection criteria for nature-based solutions, we look for projects that will have a net positive impact for biodiversity and communities.”

Thales, which did not reply to our request for a comment, says it is committed to reducing its carbon footprint. Its website states: "Thales aims to work with its entire value chain to achieve an ambitious reduction in its greenhouse gas emissions."

Babcock did not respond to a request for a comment either. The firm's carbon reduction plan can be read here.

Image credit: iStock/Jozef Durok

Carbon credits that are being used to offset the carbon footprint of large companies are probably the biggest fraudulent racket of my lifetime and costs the British tax payer millions of pounds. It does nothing to help the reduction of greenhouse gas emissions as these large companies just keep on belching out carbon, and change nothing that they have been doing in the past. The sad thing is that they are destroying our ability to produce much of our own food at home, and destroying rural Scotland and its communities into the bargain.