Most of the Scottish Government’s £8 billion private finance projects to build schools, hospitals and roads have links to offshore tax havens and the majority of the profits will go to companies outwith Scotland, according to an expert analysis for The Ferret.

A new report by a finance think tank reveals that 28 of the 47 public infrastructure projects set up by the Scottish Futures Trust (SFT) have shareholders with corporate relationships to tax havens in Jersey, Guernsey, the Cayman Islands, the British Virgin Islands, Luxembourg, Cyprus and Dubai.

The report from Dr Dexter Whitfield of the European Services Strategy Unit also discloses that, if the profits from the projects are split by equity share, companies based in Scotland will only account for the equivalent of 16 per cent of the money invested by taxpayers. The remainder will go to firms based in England or elsewhere.

Whitfield highlights the problems of secrecy, loss of tax revenue and conflicts of interest that plague offshore investments, and calls for the SFT to be scrapped and replaced by a publicly funded investment bank. Trade unions and opposition politicians are also demanding reforms, warning that vital public services are being deprived of billions of pounds of revenue every year.

The Scottish Government accepted that it wasn’t possible to prevent offshoring “in the current open market economy” but pointed out that all SFT projects paid relevant UK taxes. Offshore companies declined to comment.

The Whitfield report was jointly commissioned by The Ferret and The Guardian as part of an ongoing investigation into private finance in Scotland. The report also uncovered that public pension funds supporting tens of thousands of retired workers throughout the UK are invested in Scottish private finance projects.

Lothian and Strathclyde pension funds have between them invested a total of £145.6m in the Equitix group of funds, which are controlled offshore. Equitix funds have investments in an array of private finance projects across the country.

The administrators of the Strathclyde Pension Fund (SPF) have described its investment in Equitix in a report to councillors as “performing in excess of expectations” generating returns of 12.5 per cent. “These are valuable investments in UK infrastructure,” said an SPF spokesman.

“They are also entirely visible – having been approved by committee, with reports available to members and the public. SPF is a tax-exempt investor. It gains no tax benefit and there is no loss of tax revenue.”

According to documents filed at companies house, Equitix funds are ultimately controlled from Guernsey in the channel islands by Tetragon Financial Group through a lengthy chain of holding companies in Guernsey, London and the Cayman Islands.

Tetragon reported a “profit and total comprehensive income” of $167.8m in its most recent annual report. The Guernsey-based firm does not pay UK tax.

These profits come partly from taxpayer-funded private finance projects such as the Inverness College Campus and the Aberdeen Health Care Village. SFT runs projects under “non-profit distributing (NPD)” and “hub” programmes.

The Cayman Islands are ranked third in the 2018 Financial Secrecy Index produced by the Tax Justice Network. The campaign group says the islands offer a “low-tax, regulation-light environment for financial players.” Guernsey is ranked in 10th place.

Whitfield urges public agencies to understand the pitfalls of offshore investments. “It leads to the loss of UK tax revenue, a risk of action against offshore jurisdictions and decisions made on investment grounds that frequently have a negative impact on jobs, the local economy and the quality of public infrastructure,” he says.

“Decisions are often influenced by investment advisers with narrow interests seeking to maximise fees and fail to take account of the loss of accountability and transparency.”

Whitfield argues that “it is not credible and sustainable to be signing NPD and hub projects in which the shareholders have corporate relationships with infrastructure funds in offshore tax havens”. He recommends that the Scottish Government should “take NPD and hub companies into public ownership on book value basis to achieve savings and regain democratic accountability and control.”

The Scottish Futures Trust should be “abolished”, he says. “A publicly funded Scottish national investment bank should be established to finance national infrastructure projects, low carbon energy and retrofitting projects that address climate change and local economic development.”

Whitfield’s analysis shows that SFT schemes have less offshore ownership than historic Private Finance Initiative (PFI) projects set up by previous governments. He said 87.5 per cent of school and colleges built in Scotland under PFI were now partly or wholly owned offshore.

But the SFT model was still significantly more expensive than borrowing from the UK government and using public bodies to run projects, Whitfield argued. The SFT’s 47 schemes were built for a total cost of £2.7bn and will end up costing taxpayers nearly £8bn, according to Scottish government data.

The Commonweal think tank has also proposed that the SFT should be wound up and replaced with a national investment bank. The SNP annual conference in Aberdeen on 8-9 June is set to debate a motion calling for the Scottish Government to investigate creating a “Scottish National Infrastructure Company” to work with the proposed national investment bank.

Dave Watson, head of policy at the trade union, Unison Scotland, described the pension fund investments as “simply wrong”. Backing offshore firms means that “billions of pounds of revenue are lost every year that could have been invested in vital public services,” he said.

“We have consistently argued that Scottish Government statutory guidance should require companies who receive public money to demonstrate their commitment to stop tax dodging by signing up to the Fair Tax Mark. This makes it easy for public bodies and pension funds to avoid contracts and investment with companies who are avoiding tax and damaging public services.”

Scottish Labour economy spokesperson, Jackie Baillie MSP, called on the Scottish Government to review the procurement processes used by the SFT.

“This report exposes the staggering hypocrisy of the nationalists, who spent years campaigning against PFI only to set up a system that has enabled corporations headquartered in tax havens to own and profit from infrastructure, such as our roads, schools and hospitals,” she said.

“Now it is clear why the Scottish Futures Trust has been cloaked in secrecy by nationalist ministers for so long. What’s more, out of billions of pounds worth of contracts, barely a fifth has gone to Scottish companies to help grow our economy and create jobs.”

This was not a good use of public money, Baillie argued. “We need to create better opportunities to deliver more projects and their supply chains in Scotland.”

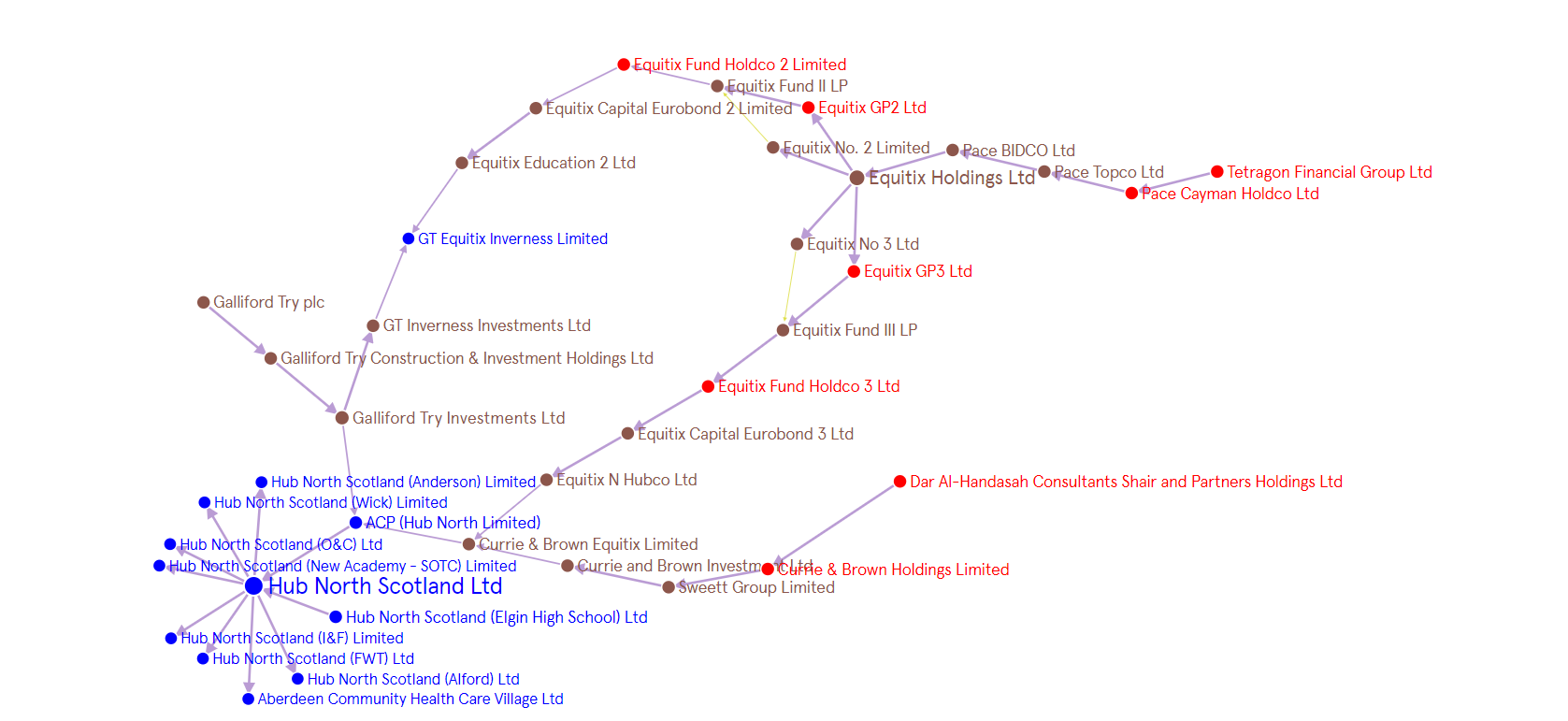

Explore the offshore links in the North of Scotland

We created a story on Graph Commons to help explain what the network below shows. Read it here.

The Scottish Greens on Edinburgh Council said they would move away from the finance model championed by the SFT, and instead back “publicly funded, publicly run and publicly accountable schools.”

Green councillor for Edinburgh city centre Claire Miller said: “The report highlights major concerns both for public sector pension investment and the private finance model advocated by the Scottish Futures Trust.”

She is planning to ask pension fund staff to outline the implications of the report for Edinburgh. This was “with a view to the fund reviewing investments that are made off-shore,” she added. “It’s clear to me that there is public support for pension investment to work for public benefit.”

Former Scottish Office chief statistician and private finance expert, Jim Cuthbert, welcomed the Whitfield report. Significant offshore ownership of private finance projects “increases the risk that projects may not be bailed out by their owners if things go wrong,” he said.

The Ferret has previously reported on criticism of a secretive charity set up by SFT in order to keep millions of pounds of private finance projects off the Scottish Government’s balance sheet.

In December 2016, we revealed that Audit Scotland and the Accounts Commission, the government spending watchdogs, planned to investigate Scottish private finance schemes to see if they are “value for money.”

The Scottish Government defended SFT projects, noting that “diverse international holdings” were a feature of the long term investment management market. “All NPD and hub projects are registered in the UK and pay relevant UK taxes,” said a government spokesman.

“In the current open market economy, it is not possible to prevent sales in the secondary markets without exerting controls that could impact on projects’ classification and bring them onto the public sector balance sheet.”

He reiterated the Scottish Government’s commitment to current SFT projects and said there were no plans to buy them out. The SFT programme had supported 5,355 construction jobs with 77 per cent of contracts awarded to Scottish firms, leaving the financial risk with private firms.

“The NPD/hub programme has enabled investment in schools, hospitals and other projects to be brought forward more quickly than would otherwise have been possible with limited UK Government capital funding and restrictions on borrowing,” he continued.

“The opportunity for public sector bodies to hold equity and invest through hub recognises the long term partnering arrangements between the public and private sector and enables the income from such holdings to be reinvested back into the public sector.”

Tetragon Financial Group declined to comment, though a source close to the company pointed out that Equitix companies registered in the UK paid UK tax, as did UK-based investors. Amber Infrastucture, which is cited in the Whitfield report, also did not comment.

Currie & Brown, a firm that has investments in SFT’s North Hub, confirmed that it had been part the international professional services business Dar Group, based in Dubai, since 2012. “In 2016 Currie & Brown acquired the Sweett Group and as a result inherited its interest in ACP: Hub North Limited. The company is committed to delivering the best value to Scottish public projects via this joint venture.”

He added: “Currie & Brown operates on a global scale in the construction industry, and since the acquisition of Sweett Group the UK represents around 40 per cent of its income. The company complies fully with all HMRC requirements for all work that the UK business undertakes. The company employs 550 people across more than 20 offices in the UK and has a long track record of delivering first-class construction consultancy services to both the public and private sectors.”

He highlighted that the Dar Group has published a UK tax strategy, which sets out the detail of the firm’s position on tax.

Full report and background documents by Dexter Whitfield

This download contains the Whitfield report and two spreadsheets giving a summary of SFT projects equity ownership and their auditors and lawyers.

Download “Offshore private finance”

Offshore-download.zip – Downloaded 812 times – 1,013.22 KBA story on the Whitfield report was also published in The Guardian on 8 June 2018.