The fire service in Scotland has been hard at work this summer after an increase in malicious fires, but a claim by the Scottish Conservatives also caused some heat on social media.

The issue of Scottish Fire and Rescue and Police Scotland having to pay VAT was resolved in 2017 after Chancellor Philip Hammond confirmed the bill would be scrapped.

On 6 August, Scottish Conservative MP Kirstene Hair claimed on her Twitter account, and in an article in The Courier newspaper, that the VAT had been an “SNP policy” scrapped by Conservative Party.

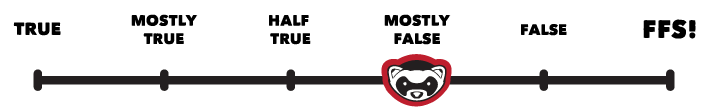

Ferret Fact Service looked into this claim, and found it to be Mostly False.

Evidence

The root of the debate around VAT and the emergency services in Scotland goes back to combining of the regional police and fire services into two single national forces – Police Scotland and Scottish Fire and Rescue Service (SFRS) – which came into force in April 2013.

This decision was made by the SNP-majority government and announced in 2011 with a consultation. SFRS then replaced the eight regional services.

However, the combination of the regional bodies resulted in Scotland’s police and fire services losing the Value Added Tax (VAT) rebate which was in place for local forces.

The rebate had been in place since VAT was introduced as a condition of Britain’s entry into the European Economic Community (EEC) in 1973. The tax was intended to avoid potential export subsidies from member countries.

Local authorities who were funded by local taxation (i.e. council tax) and revenue were exempt from paying the VAT for non-business activities. This included the local police and fire services across the UK as they were funded through local councils.

When Police Scotland and SFRS were established, the funding instead came directly from the Scottish Government and as such did not qualify for the refund.

The claim by Kirstene Hair was that the VAT issue was an “SNP policy”. This is not accurate, as VAT is a reserved issue and changes to the VAT rebate can only be made in Westminster. Scotland does not currently have the power to cancel the VAT cost.

It is fair to say that the removal of the refund was a result of an SNP policy, as the amalgamation of the fire and police services put them outside the exemptions codified in Section 33 of the 1994 VAT Act.

A freedom of information request revealed that discussions were held between the Scottish Government and the Treasury in 2011 about the potential impact of the mergers on VAT.

Treasury officials warned the Scottish Government that because funding for Police Scotland and SFRS would be centrally controlled, and not come from regional taxation, it would be unlikely to fall under the exemption and would be liable for VAT.

Trade union UNISON Scotland also highlighted concerns in their response to a consultation on the merger in 2011. A SPICe report also warned that that issue of VAT had not been resolved.

The ultimate decision over whether Police Scotland and Scottish Fire and Rescue would be liable for VAT was not taken by the Scottish Government, which actively lobbied the UK government to allow an exemption for the services. This lobbying was rejected.

Whether the 1994 VAT allowed for the merged forces to be exempt is a matter of interpretation, but it is clear that the Treasury decided it did not. British Transport Police and the Ministry of Defence police are also liable for VAT on certain goods and services due to their national funding status.

Chancellor Philip Hammond revealed in the 2017 budget that the exemption would be extended to include SFRS and Police Scotland.

The UK government said: “Presently the definition of local authority in section 33 of VATA does not include a ‘combined authority’, with the result that it has been necessary to include these bodies by enacting individual Treasury Orders once they have been established.”

Where credit lies for the change is hard to say. Philip Hammond said that Scottish Conservative MPs persuaded him “that the Scottish people should not lose out because of the obstinacy of the SNP government.”

However, the SNP and other parties, including Labour and the Liberal Democrats had been lobbying for the change in VAT exemption since the merger of the fire and police in Scotland, and had repeatedly raised the issue in both the Scottish and Westminster Parliament.

Ferret Fact Service verdict: Mostly False

While it is clear the Scottish Government was aware that the merger of Scottish fire and police services was likely to cause the consolidated forces to lose the VAT-exempt status of the regions, it is not accurate to describe the cost as an SNP policy as the power over VAT changes lies with Westminster and the Treasury, rather than the Scottish Parliament.

Ferret Fact Service (FFS) is a non-partisan fact checker, working to the International Fact-Checking Network fact-checkers’ code of principles. All the sources used in our checks are publicly available and the FFS fact-checking methodology can be viewed here. Want to suggest a fact check? Email us at factcheck@theferret.scot or join our community forum.In response to an evidence request, the Scottish Conservatives provided evidence of the Scottish Government’s knowledge of the VAT exemption being under threat, and links to Phillip Hammond’s speech praising Scottish Conservative colleagues.